While traditional mortgage lenders require buyers to sign endless paperwork, if you are one of those sellers who agreed to give your buyer a mortgage, you become the lender now. You should, therefore, treat this process with the same vigilance required when using a free owner finance contract form.

Without the proper legal protections and terms in place, you’ll have nowhere to turn to if the buyer defaults on the note. To avoid this, you need to guard your interest as the financier and the seller.

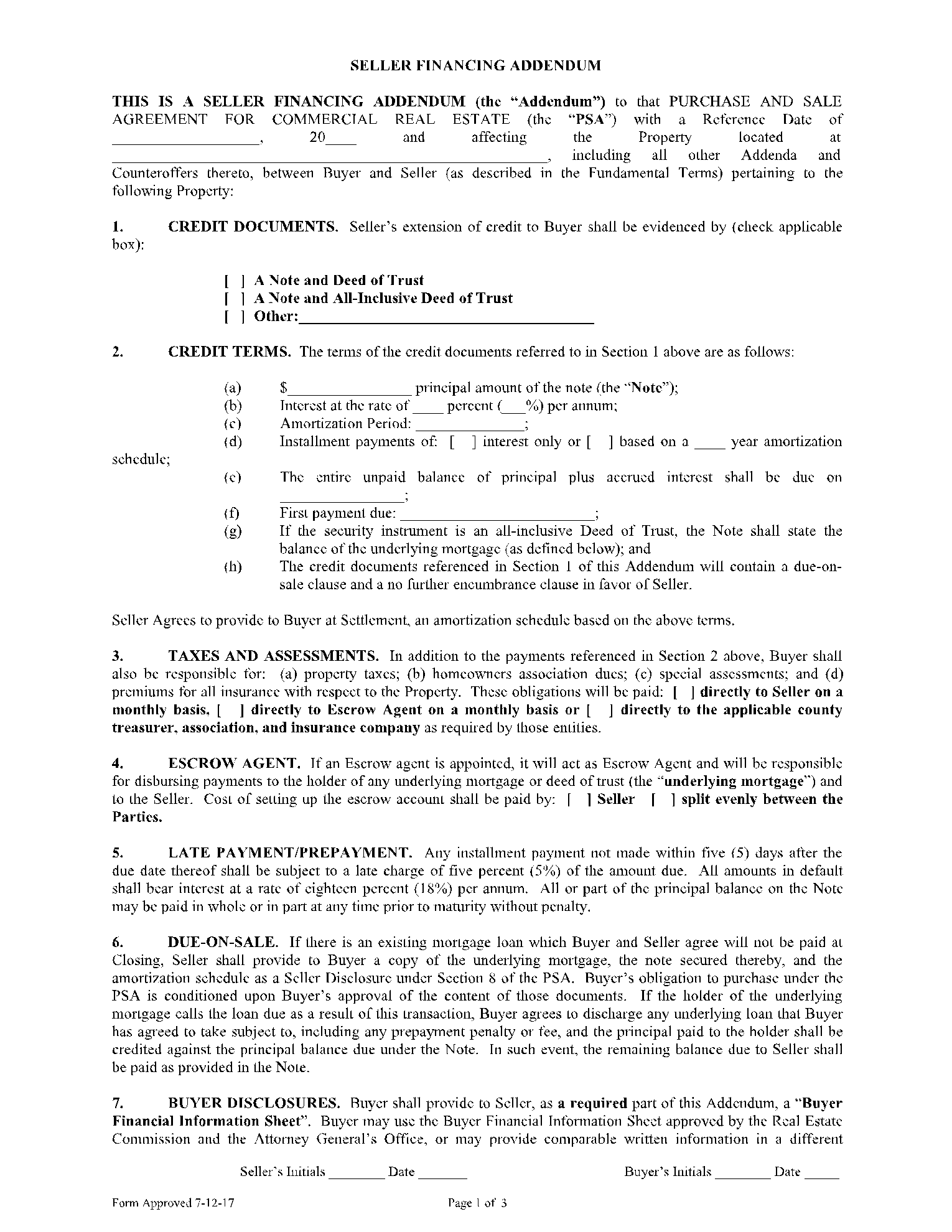

What’s a Seller Financing Contract?

Commonly termed as owner financing contract, a seller financing contract is agreed upon between the seller and the buyer. The seller provides the money instead of the mortgage lender. The only difference is that this time the money is not going through the bank. Ideally, the financing addendum squarely rests on the seller.

Meaning that the previous owner of the house can act as a lender. The buyers are then granted a loan to purchase the property and a precise timeframe of when they should repay the loan. What’s unique about seller financing is that it provides the seller with incremental cash flow.

What’s included in a Seller Financing Contract Template

First, you need to know that any seller financing contract should be used together with a sale agreement. While the sale agreement allows the transfer of ownership from one person to another, the seller financing contract outlines the terms to be followed.

Since properties are different, no seller financing contract is going to be exactly like the other. Here are the things included in a seller financing contract. Remember, there are several free owner financing contract forms and seller financing contracts to use.

Identify the Buyer and Seller: This section of the seller financing contract resembles other real estate contracts. It identifies who the seller and buyer along with the following details:

- Full purchase price: This portion outlines how much the property will be sold for.

- Down payment amount: This indicates whether the buyer will pay a down payment.

- Loan balance: This shows the percentage of the purchase price paid through a loan.

- Interest rate: This is the amount of interest rate that will accrue on a loan.

- Re-payment details: This shows the buyer’s total amount to pay to the owner and at what frequency.

- Start and end dates: This is when the first payment is due, and the loan will be cleared.

How to Use a Seller Financing Addendum

If the mortgage lenders are restricting their lending and the economy is not performing well, using a seller financing supplement can help you dispose of your house fast. The seller financing contract specifies many terms and conditions of the agreement. To fill it, you have to download the form by tapping the button given above and follow the steps below.

- Hire a Lawyer:

While a seller can download a supplement in the form of a seller financing contract PDF, he should first consult with his lawyer to ensure that the contract meets all the requirements.

- Schedule Meeting:

Schedule a meeting with the purchaser to fill the form. By signing sellers financing addendum together, you’ll make the process easier.

- Complete the addendum:

While completing the addendum or the owner financing contract template, fill in your name, the buyer’s name, and the property’s description.

- List the terms of the loan:

List down things such as the amount, the loan’s interest rate, and the amount the buyer will pay every month. You also need to state the loan duration.

- Tax Information:

Choose whether the buyer will prepay the proper taxes and insurance or not.

- Include credit verification:

Make sure you include any verification the seller must provide to you before you approve the loan.

Conclusion

In the recent past, seller financing contracts have been one of the best ways to buy properties. It not only makes closings much more accessible, but you also don’t have to go to the bank. By reading this article, you only need to download the seller financing contract template and learn how to fill it.